03/01/2022

Thoughts on the Tragedy in Ukraine

Ukraine update:

Amid the ongoing tragedy happening in Ukraine we wanted to share some thoughts. First, our hearts go out to the people of Ukraine and the hardships they are facing, which are heartbreaking and senseless. It seems callous to focus on the financial impacts, however, it's our role and responsibility as advisors to think through how these events can impact our client's financial well being, so here goes:

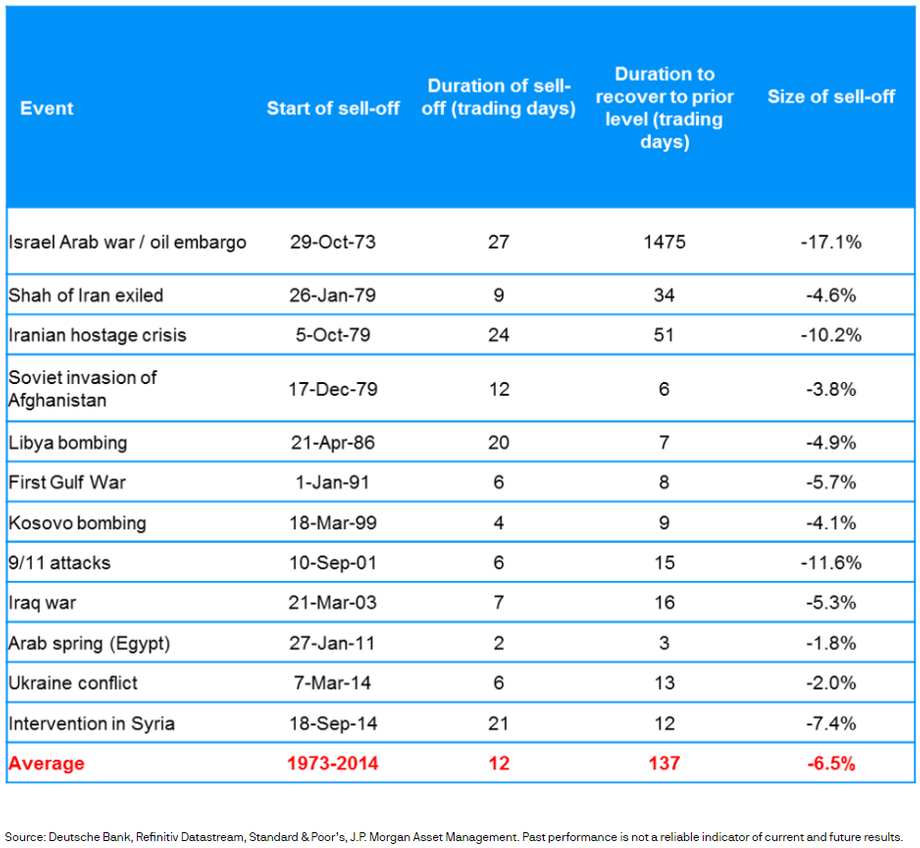

The near-term uncertainty surrounding the Russia-Ukraine war is significant, still unfolding, and difficult to predict. It is reasonable to assume things will get worse before they get better. But ultimately, we are cautiously optimistic that a diplomatic solution/cessation of the fighting will be achieved. In the meantime, markets are likely to remain volatile and there may be further downside. A good starting place is to look at how financial markets have performed during past geopolitical war events. The table below illustrates that markets typically sell off quickly but also often recover quickly (please note the table was produced on 2/25/22 by Litman Gregory so the return data for the current crisis is not updated).

The reasons why this conflict has the potential to be different from previous ones were highlighted in a recent column by author Thomas Friedman. Here's the link to his column, there may be a paywall. https://www.nytimes.com/2022/02/25/opinion/putin-russia-ukraine.html?searchResultPosition=3 In the column he made the point that this war has no historical parallel, “It is a raw, 18th-century-style land grab by a superpower—but in a 21st-century globalized world. This is the first war that will be converted on TikTok by super-empowered individuals armed only with smartphones, so acts of brutality will be documented and broadcast worldwide without any editors or filters.” We can hope this unfiltered view of the atrocities will bring global and domestic pressure on Russia to seek an early end to the war. However, as Friedman highlights in his column, “Putin has more unchecked power than any other Russian leader since Stalin”, making it challenging to gauge what impact global pressure and sanctions will have on his decision making. Putin remains a wildcard.

This past weekend both President Vladimir Putin and Foreign Minister Sergei Lavrov both asserted the current Ukrainian government is illegitimate and have insisted on Ukraine's “denazification and demilitarization,” which is a strong signal that Moscow's ultimate goal remains regime change. Please note: we started writing this commentary over the weekend and quickly realized that events are evolving so quickly it wasn't a good use of our time to try and explain what's happening in Ukraine knowing that it could easily change by the time we send out this commentary. With that in mind, we are attaching an analysis from one of our geopolitical research resources, Stratfor, on several potential courses of action Russia could take in Ukraine, with each having pros and cons. I found their analysis to be helpful in understanding the potential outcomes and for those of you with an interest to learn more please read the attached. Below are some thoughts on things we can control, namely portfolio strategy, and how we can help our clients navigate these troubling and volatile times.

- Building well-diversified investment strategies: the adage “don't put all your eggs in one basket” has been around for more than 100 years for a good reason, it works! This current Ukraine crisis has demonstrated the importance of diversifying into different asset classes that are not perfectly correlated, and we can see this in the performance data. Most of our portfolios are down substantially less than the broad markets, and we have avoided the dramatic sell-offs in the most speculative parts of the market.

- Tactical asset allocation shifts: based on extreme market moves the past few years and our outlook on the markets we have been well positioned in segments of the market that have held up well this year and some that have benefited from the crisis. In most portfolios, this has included exposure to real return assets that may perform well in an inflationary environment like commodities, energy, precious metals, and inflation-protected securities. Positions in cybersecurity stocks and energy transition have held up well. We have also been tilted towards value-oriented segments of the market which have held up significantly better than most growth parts of the market.

- Liquidity matters: investors get into trouble when their liquidity needs are misaligned with their portfolio allocations. In other words, they are too aggressively allocated relative to their spending needs and are often forced to sell at market lows. We regularly review our client's portfolios to evaluate whether they have ready liquidity to meet their spending needs. Having liquidity in place ahead of time is crucial to not having to panic sell at market bottoms. We will continue to review liquidity on a case-by-case basis to ensure adequate levels. This may include cash reserves as well as high-quality assets that are easily sold in volatile markets (short-term bonds, core bonds, etc.).

- Re-balancing portfolios: the discipline of rebalancing portfolios helps to improve results and limit volatility. This involves selling asset classes and positions that become overvalued and too large in portfolios and also adding to positions that become undervalued and too small in portfolios.

- Tax-loss selling: volatile times like this create opportunities to proactively harvest tax losses and reinvest into similar or better investment opportunities. We expect to be actively looking for opportunities to do some tax-loss harvesting that will benefit your portfolios for the long term.

- Financial planning is our guidepost: for many clients, we have already done extensive planning and have a clear understanding of their portfolio needs to meet their financial goals. In many cases, we have stress-tested portfolios to understand the impact market sell-offs may have on their financial goals and have adjusted portfolio strategies accordingly. If you are concerned about meeting your goals and would like to discuss financial planning let us know.

- Call us: we know watching current events and volatile markets are stressful. If you have any questions about your investments please don't hesitate to call us.

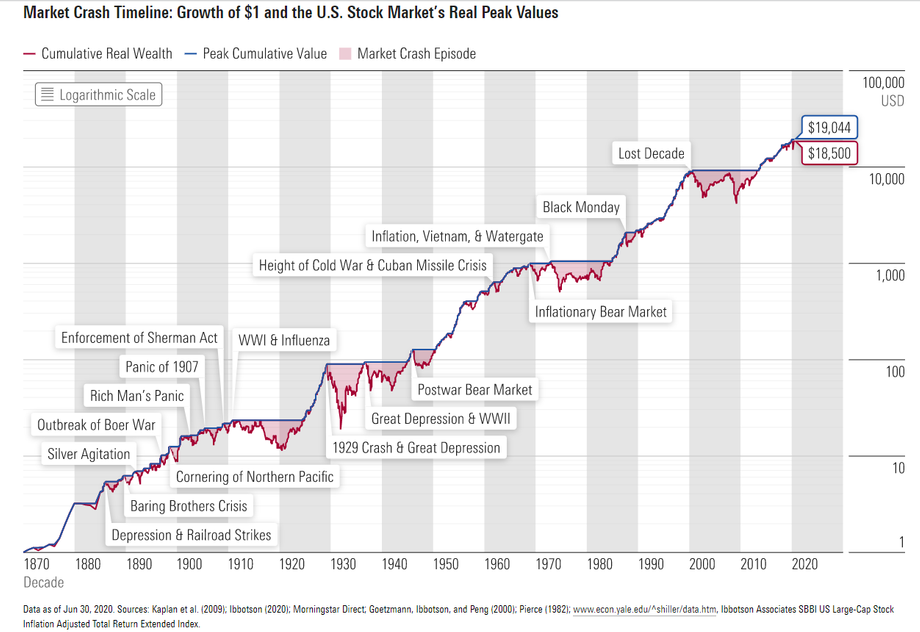

Lastly, the chart below is a good reminder that we have been through difficult market environments many times before. These periods can be stressful but history has shown us it usually doesn't pay to bet against the ingenuity, resiliency, and earnings capacity of capitalism and the growth potential of stocks for the long term. We will get through this period and are likely to see some good investment opportunities as we emerge from it. Please don't hesitate to call if you would like to discuss your investments or anything else in this commentary.