11/01/2022

2022 Year-End Charitable Giving Tips

As we approach the year-end holidays and giving season, your charitable strategy can be a powerful force to make a difference for the causes you care about and potentially minimize some of your tax burden. Below we highlight four strategies to consider if you are making year-end gifts. Please do not hesitate to contact us if you have questions or want to discuss the best strategy for your situation. Also, keep in mind that some charitable strategies may require additional lead times to meet the year-end deadline so the sooner you start, the better.

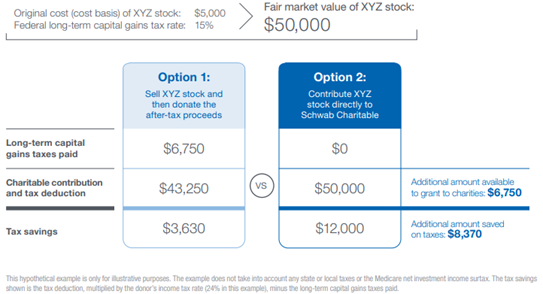

Gift Appreciated Securities. One of the most effective strategies for giving with maximum charitable impact and minimizing taxes is to donate appreciated securities from a taxable account that you have held for more than one year. Donors that use this strategy generally can eliminate the capital gains tax they would otherwise incur if they sold the assets first and donated the proceeds. With long-term capital gains tax being as much as 20%, eliminating this tax can increase the number of funds available for charities and help save on personal taxes as well. Below is an example of what this could look like:

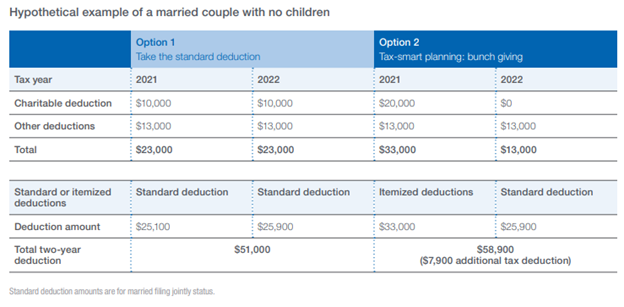

Bunch Your Gifts. Keep in mind, that taxpayers typically only receive a tax break for charitable gifts if they itemize deductions on their taxes. In 2022, the standard deduction for individuals is $12,950 for individuals and $25,900 for those married and filing jointly. One strategy that allows individuals to continue donating and receive tax benefits is to “bunch” donations to charities in specific years while limiting donations in other years. In the bunch years, the large charitable contributions combined with other itemized deductions increase the likelihood you will exceed the standard deduction and be able to deduct your charitable gifts. Below is an example of the potential tax benefits of bunching your charitable gifts:

Use a Qualified Charitable Distribution (QCD). This is a great strategy for charitably inclined individuals that have an IRA and are over the age of 70 ½. A QCD allows IRA owners to transfer money directly to charities, up to a total of $100,000 each year. If handled properly the QCD will exclude the IRA distribution from gross income, which is more valuable than taking a charitable deduction. In addition, a QCD may be a benefit if you are subject to the Medicare Income Related Monthly Adjustment Amount (IRMAA). This is a great and under-utilized gifting strategy, but make sure to check with your tax advisor before implementing it.

Open a Donor Advised Fund (DAF). A DAF is a great way to bunch your charitable gifts, and in many ways operates like a miniature version of a private foundation. It allows you to make a charitable contribution today, receive an immediate tax deduction, and then over time, you can make grants out of that fund to individual charities as you see appropriate. In addition, the tax benefits for giving to a DAF are usually higher than giving to a private foundation. A DAF can be opened with as little as $5,000. If you have an interest in opening your own DAF, please let us know and we'd be happy to assist you with the process.

Please give us a call if you would like to discuss your year-end charitable giving plans.