03/31/2022

Energy Transition

Last year we recommended energy transition as a secular theme we wanted to have exposure to in our portfolios. As part of our research, we identified GMO as the best investment manager in the energy transition space and started a position in the GMO Climate Change fund. We selected GMO not because they invested in all of the sexiest technologies (many of which are unprofitable), but rather because they understood the impact the transition to clean energy would have on metals, minerals, and other industries. Based on our research, GMO's investment approach seemed to offer the best combination of new technologies and fundamental industries that would be necessary to lead the transformation of the energy and climate industries. Adam Tooze, on his excellent website Chartbook, recently published some insightful thoughts on the subject of energy transition and its impact on the metals and minerals industry. Enjoy his comments below:

The energy transition is proving to be inflationary in two respects: investment in it is driving the price of hard commodities, while oil prices rise due to weak supply, driven by environmental policies, investor demands for high returns, and possibly the simple exhaustion of easily accessible reserves in the ground.

Isobel Schnabel of the ECB provided a good summary of the first inflationary effect in a speech about policy responses to "greenflation":

Most green technologies require significant amounts of metals and minerals, such as copper, lithium, and cobalt, especially during the transition period. Electric vehicles, for example, use over six times more minerals than their conventional counterparts. An offshore wind plant requires over seven times the amount of copper compared with a gas-fired plant. No matter which path to decarbonization we will ultimately follow, green technologies are set to account for the lion's share of the growth in demand for most metals and minerals in the foreseeable future. Yet, as demand rises, supply is constrained in the short and medium-term. It typically takes five to ten years to develop new mines... Export restrictions on Russian commodities may add to pressure on prices over the near term... the faster and more urgent the shift to a greener economy becomes, the more expensive it may get in the short run...

...the significant need for private and public investment associated with the green transition itself is a reason to believe that real interest rates may rise from their subdued pre-pandemic levels.

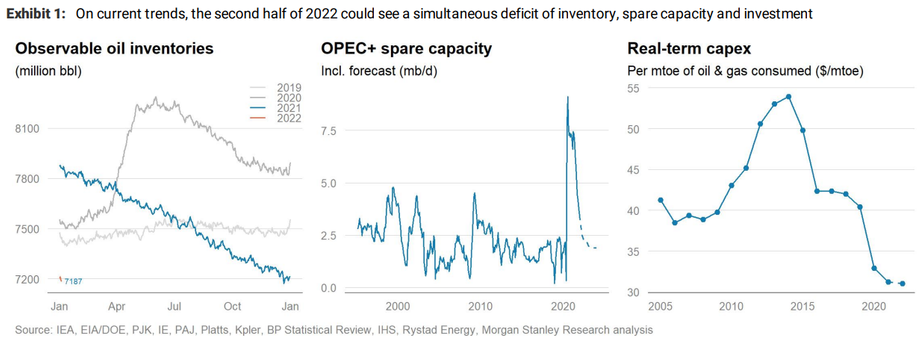

She provides this eye-popping chart of percent changes in key “green” metal prices:

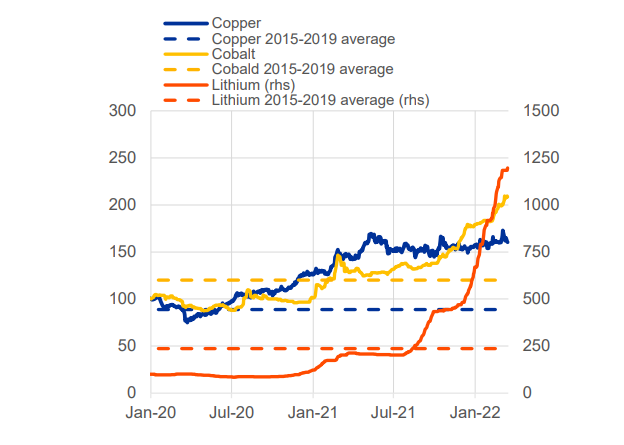

The likelihood of lasting upward pressure on oil prices is neatly described in this graph from Morgan Stanley, showing historically low inventories above ground, diminishing spare capacity among Opec countries, and low investment: