01/11/2024

Spot Bitcoin ETFs Are Here. Should You Invest?

AWM is not making a recommendation to purchase a position in one of the new Bitcoin ETFs, however, we do want to provide investors with quality information so they can make informed decisions on whether Bitcoin ETFs are right for them. The below article from Morningstar is one of the better write-ups we have seen on the recent decision of the SEC to approve Bitcoin ETFs and is a good place for potential investors to start their research.

Spot Bitcoin ETFs Are Here. Should You Invest? Bryan Armour, Morningstar 01/10/2024

Why they hold advantages over bitcoin futures ETFs and how to choose the right one for your portfolio. More than 10 years after the first filing, the U.S. Securities and Exchange Commission finally approved a spot bitcoin exchange-traded fund. In fact, the SEC approved 11 "Spot Bitcoin ETFs", giving investors options right off the bat. Trading should start tomorrow, Jan. 11. Which ETF will reign supreme is up for debate. But one thing is clear: Spot Bitcoin ETFs are the best option on the fund market for Bitcoin investors.

What Is a Spot Bitcoin ETF?

“Spot Bitcoin ETF” is just the official name for an ETF that holds Bitcoin. The performance of these ETFs should follow Bitcoin prices closely, minus fees and the fund's trading costs. A spot price is the immediately available price of a security. Futures prices, on the other hand, represent prices at a future date. Stocks and bonds trade at spot prices (that is, current prices), while products like commodities trade at future prices (which allows buyers to lock in a specific price and complete the transaction at a future date). The only reason we call the newly approved ETFs “Spot Bitcoin” is because Bitcoin futures ETFs made their debut first. Bitcoin futures ETFs entered the market in October 2021. If a spot Bitcoin ETF had been approved first, we may well have simply called them “Bitcoin ETFs.”

Should You Invest in Spot Bitcoin ETFs?

Investors don't need to take a stance on Bitcoin. Fear of missing out is a poor investment strategy, and investors should only invest in these ETFs if they see value in doing so. Below are a few considerations when deciding whether to invest in Spot Bitcoin ETFs.

Spot Bitcoin ETFs Are a Better Option Than Alternatives

Fees: The SEC's decision to approve multiple filings at the same time created fierce fee competition between issuers during the application process, which is good for investors. Lower fees and costs become paramount to attracting new assets, leading issuers to come to market with competitive fees. Spot Bitcoin ETFs significantly undercut the exorbitant fees charged by current crypto funds. The range of Grayscale Trusts currently charges 2% to 3%, and the largest Bitcoin Futures ETF charges 0.95%, a far cry from the 0.20% price tag in Bitwise's spot Bitcoin ETF filing.

Futures Drag on Performance: While the SEC dragged its feet on spot Bitcoin ETFs, it approved the first Bitcoin futures ETF more than two years ago. ProShares Bitcoin Strategy ETF (BITO) was the most heavily traded ETF debut ever. But as we said at that time, “These aren't the Bitcoin ETFs you're looking for.” Bitcoin futures ETF investors pay an extra fee to roll from one futures contract to the next, something spot Bitcoin ETFs don't need to worry about.

Non-ETF Grantor Trusts Struggle to Track Net Asset Value: Grantor trusts like Grayscale Bitcoin Trust (GBTC) benefited greatly from a lack of better options. GBTC was one of the few ways investors could get exposure to Bitcoin without opening an account to trade on cryptocurrency exchanges. It launched in 2013, peaking at $40 billion in assets under management in 2021. That first-mover advantage netted Grayscale billions in fees, in part thanks to the alarmingly high 2% fee. The problem for investors is that these grantor trusts operate more like closed-end funds. Adding and redeeming shares takes time and effort. Without the ability to easily regulate the size of the trust, managing supply and demand becomes a major issue. This wasn't a problem for GBTC holders when it traded at a premium—Grayscale even stepped in to meet high demand by issuing more shares via private placement. But Grayscale's helping hand was nowhere to be found when GBTC began trading at a steep discount, leaving its investors to sell their shares for significantly less than their value. Spot bitcoin ETFs should track their net asset value much more closely than early Bitcoin trusts, which makes them a safer option for investors. And shares can be created and redeemed every day, which should keep demand and supply in balance.

Spot Bitcoin ETFs Aren't as Efficient as Most ETFs

Although spot Bitcoin ETFs are overall a better option for investors than Bitcoin futures ETFs, they don't yet offer the efficiency that investors have come to expect from other ETFs. ETFs have become hugely popular because of their low costs. In-kind creations and redemptions allow ETF portfolio managers to limit trading and avoid transaction costs. Spot Bitcoin ETFs won't benefit from these in-kind creations or redemptions (at least, not yet). The SEC only approved cash creations and redemptions, meaning the ETF will need to bear the costs of buying and selling Bitcoin when ETF shares are created or redeemed. Trading costs could eat away at the edges of spot Bitcoin ETF performance. The extent of these costs remains to be seen. Investors on the fence about whether to buy a spot Bitcoin ETF may prefer to stick with traditional ETFs until this inefficiency is resolved.

The Unique Risks of Bitcoin

The average ETF investor likely hasn't experienced volatility like Bitcoin. Over the past five years, Bitcoin's standard deviation of returns is nearly 4 times that of the U.S. stock market, as proxied by the Morningstar US Market Index. That said, much of Bitcoin's volatility was to the upside, but that's not always the case. Bitcoin prices have had drawdowns of at least 45 percentage points four times in the past five years, and the current price remains 37 percentage points below all-time highs. Risks don't stop at price swings. There's little precedent for the myriad dangers facing Bitcoin investors, such as the manipulation and fraud that have been rampant in cryptocurrencies. A Bitcoin ETF doesn't directly inherit that past, but the price of Bitcoin is connected to other potentially affected entities. Spot Bitcoin ETFs are particularly exposed to counterparty risk regarding cryptocurrency exchange Coinbase (COIN), which spot Bitcoin ETF issuers rely on heavily. Coinbase is the named “Bitcoin custodian” on most of the ETF filings, meaning Coinbase will be responsible for the security of all the private keys of Bitcoin held by these ETFs. Coinbase is also likely the exchange where Bitcoin trading will occur for the ETFs when creations and redemptions require it. Coinbase is the entity responsible for surveillance-sharing agreements with the ETFs' listing exchanges—an SEC mandate for a better line of sight into crypto markets where trading could affect ETF prices. Much relies on Coinbase's safe passage.

Bitcoin Is Difficult to Value

Bitcoin is a speculative investment. There is no fundamental reason why it is priced where it is today. It is at the whims of supply and demand, making future prices hard to predict. My colleague, Madeline Hume, took a look at four valuation methodologies for pricing Bitcoin. Her conclusion? Each is flawed in its own way, and there doesn't seem to be much appetite for improving them. Investors must understand that Bitcoin prices, and therefore, these ETFs are untethered from a fundamental value. Don't buy these ETFs if that makes you uneasy.

How to Choose the Right Spot Bitcoin ETF for You

Spot Bitcoin ETFs should all deliver the same thing: exposure to Bitcoin. Physically holding Bitcoin doesn't leave much room for issuers to carve out an edge. However, that doesn't mean these ETFs are all equal. Investors can pick the best option for themselves by focusing on three fund criteria: fees, liquidity, and fund trading costs. Buy-and-hold investors should emphasize fees, those actively trading ETFs should focus on liquidity, and everyone should keep an eye on how trading costs affect performance.

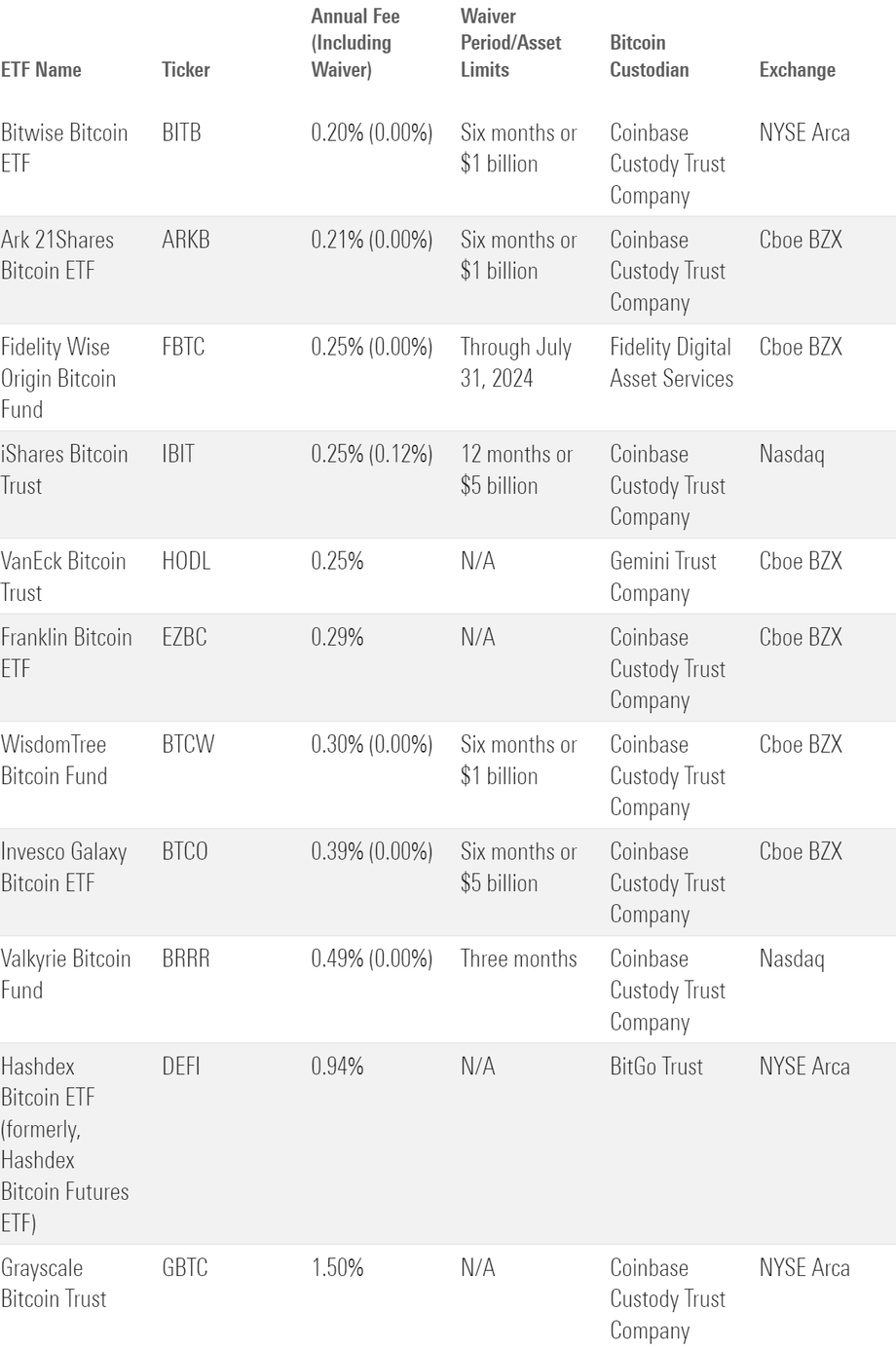

Buy-and-Hold Investors: Focus on Fees: This isn't the first time several issuers have provided access to essentially the same strategy. Before fees, the returns of gold ETFs or S&P 500 trackers are nearly identical. Like those strategies, fees are likely to be the biggest differentiator between spot Bitcoin ETFs' total returns. Bitwise Bitcoin ETF is tagged with the lowest ongoing fee of 0.20%. But fees on ETFs from ARK, Fidelity, VanEck, and iShares all fall within 5 basis points of Bitwise's ETF. Issuers also made use of fee waivers to help attract assets out of the gates, six Bitcoin ETFs will launch with a 0.00% fee after waivers. Each waiver has its limitations—most last for six months and only apply to the first $1 billion to $5 billion in assets. Waivers are temporary; investors should focus on the long-term and stick with one of the lowest-cost ETFs after the waiver periods end. This still leaves plenty of options. The one outlier is Grayscale, whose proposed fee is currently 1.50%. Investors won't get anything in return for this higher fee. They should look elsewhere for their Bitcoin exposure. The impact of fees on performance will likely be dwarfed by Bitcoin's volatility. But buy-and-hold investors would be leaving money on the table by settling for a more expensive ETF.

Active ETF Traders: Prioritize Liquidity: Investors have their own costs to worry about. Frequent trading and large trades come with liquidity costs that can add up quickly. Buy-and-hold investors are far less exposed to liquidity risks than market makers and day traders. For those looking to actively trade spot Bitcoin ETFs, liquidity costs can be broken into two parts: crossing the bid-ask spread and depth of liquidity.

- Crossing the bid-ask spread. Traders pay a cost each time they buy the offer or sell the bid. In theory, fair value exists somewhere in the middle of a given bid-ask spread, making the midpoint a good proxy. If two ETFs were worth the same price of $10.00, it would be cost-effective to buy the offer of a $9.99 bid/$10.01 ask compared with a $9.95 bid/$10.05 ask.

- Depth of liquidity. Investors are keen to find enough shares to buy or sell near the current price; otherwise, they will receive suboptimal prices when executing a large trade. Tighter bid-ask spreads often indicate deeper liquidity, meaning more shares available to buy or sell near the current price. This is critical for investors trading large chunks of shares at one time so that the market impact of their trading doesn't overly influence the price.

All Investors: A Fund's Trading Costs: The SEC sapped spot Bitcoin ETFs of their wrapper's superpowers by requiring cash creations and redemptions. As a result, the ETFs are responsible for trading Bitcoin when shares are added or redeemed, leaving the fund and its investors to foot the bill for any trading costs. These include transaction costs, the cost of crossing the bid-ask spread, and market-impact costs. Differences between issuers may be small, but this is a rare occurrence where an issuer with two ETFs to its name (Valkyrie) is competing directly with the world's largest asset manager (BlackRock). There could be an advantage for issuers with deeper resources and capital markets experience and expertise. Perhaps a deeper connection to the crypto community will benefit an issuer like Bitwise or VanEck.

Here's a look at the different ETF options coming to market: Choose Your Fighter

All else equal, investors should want the asset manager with a Bat-Phone into market makers and other liquidity providers, be that for their own ETFs or when trading in crypto markets. Investors should keep an eye on performance to see which issuer holds the edge.